In Australia, over 1.2 billion invoices are exchanged annually. Typically, invoices are exchanged via email, post or fax. But there is a new kid on the block; electronic invoicing or e-invoicing for short.

Just as the introduction of email made fax and post nearly redundant, e-invoicing will make traditional and more time- consuming methods of invoicing a thing of the past. The process of e-invoicing takes advantage of modern data transfer technology in an effort to better service businesses and their suppliers securely and efficiently.

The process cuts down on the opportunity for human error therefore reducing the number of delays in an invoice exchange allowing for users to pay their suppliers sooner and better manage their cash flow. There are plenty of advantages to e-invoicing, but in order to reap them, you first need to understand how e-invoicing works and why you should adopt it as a standard bookkeeping practice in your small business.

What is e-invoicing and how does it work?

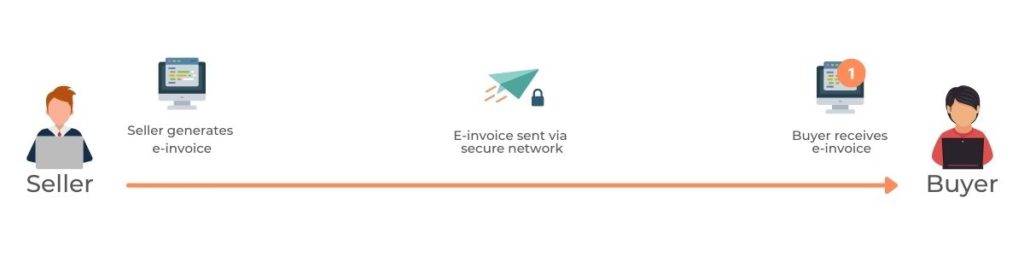

E-invoicing is the process of sending an invoice directly from one business’ accounting system into another. Rather than sending an email, fax or letter, an e-invoice is delivered directly via a secure e-invoicing network. This process means that businesses will no longer need to generate paper or PDF invoices that must be printed, posted, or emailed to their customers. Similarly, the invoice recipient will not have to manually enter or scan invoice information into their accounting software once they receive it. Even if the buyer and supplier use different accounting software, e-invoices can be issued between them as long as both are connected to the same e-invoicing network.

Traditional invoicing process

E-invoicing process

The network that Australian accounting services, for example Xero accounting software, are connected to is called Peppol. 38 countries around the world, including Australia and New Zealand, use the Peppol network for e-invoicing. The Australian and New Zealand governments signed a Trans-Tasman agreement in 2018 to implement e-invoicing and commit to a standardised approach to exchanging invoices over the secure Peppol network.

Businesses who wish to send and receive e-invoices must use Peppol-enabled accounting software to do so. The service providers listed on this register have completed the Australian Peppol Authority accreditation process and are trusted to operate on the network. The handy thing about this neutral network is that it does not matter what service provider you and your customer use, so long as they are both Peppol-enabled.

In order to get the e-invoicing ball rolling, the Australian government has mandated the use of e-invoicing for government agencies by July 2022. In addition, since the 1st of January 2020, the Australian government has pledged to settle all e-invoices under $1 million within 5 working days. Because of this, many businesses are enjoying the benefits of this efficient system already.

Read more about e-invoicing at business.gov.au.

Get paid faster and with less hassle: the benefits of e-invoicing

Did you know: On average, Australian businesses are paid 9 days late for services they have provided? In 2016, Deloitte Access Economics research found that 20% of payment delays are caused by incorrect invoice information and a further 20% are due to invoices being sent to the wrong person.

E-invoicing saves time, effort, paper and money for both the vendor and the customer because the opportunity for error is dramatically reduced. With less data entry required at both ends of the transaction, businesses do not waste valuable time re-generating invoices to resolve an error.

Data entry isn’t the only place where human error occurs in the typical invoicing process. Another part of the procedure where delays can happen is in the delivery. Miss-spelled email addresses, emails going straight to the spam-folder and email security breaches are all factors that frequently hold up payments.

Perhaps one of the most important benefits of e-invoicing is the level of security it offers to those who use it. Businesses who use e-invoicing are less likely to encounter a breach of security because e-invoicing removes the need for emails entirely. Emails are risky because they can be intercepted, copied, imitated or otherwise compromised. Businesses are protected from phishing scams and other fraudulent online activities when using e-invoicing because the transfer of invoice data happens on the secure Peppol network. In addition, because both sender and receiver need to be registered with the Peppol encrypted Network, providing their ABN and business details – small businesses are less likely to be scammed by suppliers providing false or expired ABNs. But of course, businesses looking for increased cyber security from using e-invoicing must also have basic cyber safety in place in their business or they will remain at risk. For information about cyber security fundamentals for small businesses head to our Digital Bizkeeper 101 course.

Getting started with e-invoicing

To reap the benefits of e-invoicing and get your money faster, you first need to be using a Peppol-accredited accounting software provider. As e-invoicing is relatively new to Australia, some accounting systems are still developing their e-invoicing functionality. Many have partnered with Peppol-accredited services such as Link4 or MessageXchange to offer e-invoicing as an add-on within their software.

We’ve researched and reached out to the most popular small business accounting software providers in Australia to find out how far into the process they are in making e-invoicing available. So, if you’re ready to take the next step, click on the links below to compare providers and get in touch with their sales teams to discuss how they can best service your business’ bookkeeping needs. We also recommend speaking with a trusted advisor who knows your business to determine which service provider is best suited to you.

Below is a list of Australia’s most popular digital accounting service providers for small businesses and links to more information:

- Xero’s e-invoicing information page.

- MYOB’s e-invoicing information page.

- Reckon One’s e-invoicing information page.

- Intuit Quickbooks does not have any e-invoicing information on their website but have partnered with Link4 as well as MessageXchange. Reach out to their sales team to learn more.

- Saasu does not have any e-invoicing information on their website but have partnered with Link4. Reach out to their sales team to learn more.

- Sage does not have any e-invoicing information on their website but have partnered with Link4. Reach out to their sales team to learn more.

- Rounded is currently in the process of establishing e-invoicing functionality.

With e-invoicing, you avoid the time and effort involved in generating PDF or paper invoices for clients by instantly sending them an electronic copy instead. Removing the risk of human error means that you can get paid faster and will no longer need to waste time and money chasing clients for payment. To learn more about e-invoicing and the steps you can take to get started, head to business.gov.au.

If you’re interested in learning about other digital tools and processes that can save you time and money in your business, you can apply to join the free Next Steps Challenge – a 5 day online course that sets small businesses up for success.